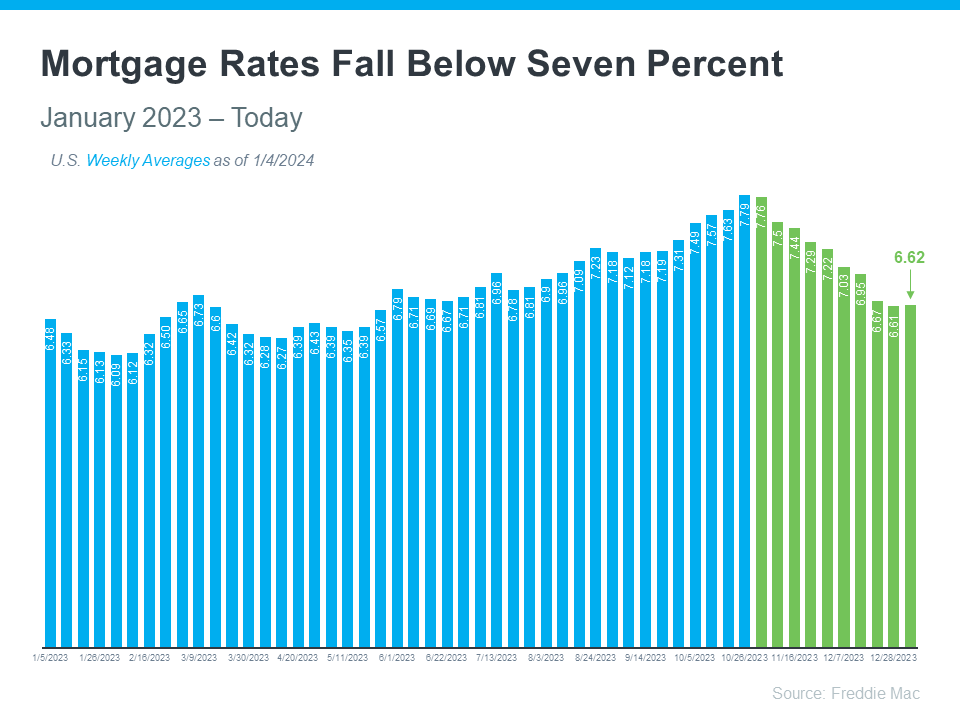

When buying a home, mortgage rates impact what you can afford and how much you’ll pay each month. And the latest news is positive. Rates on 30-year fixed mortgages have significantly fallen, since the end of October to below 7%, as reported by Freddie Mac (see graph below):

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

Supporting this idea, Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA), affirms:

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

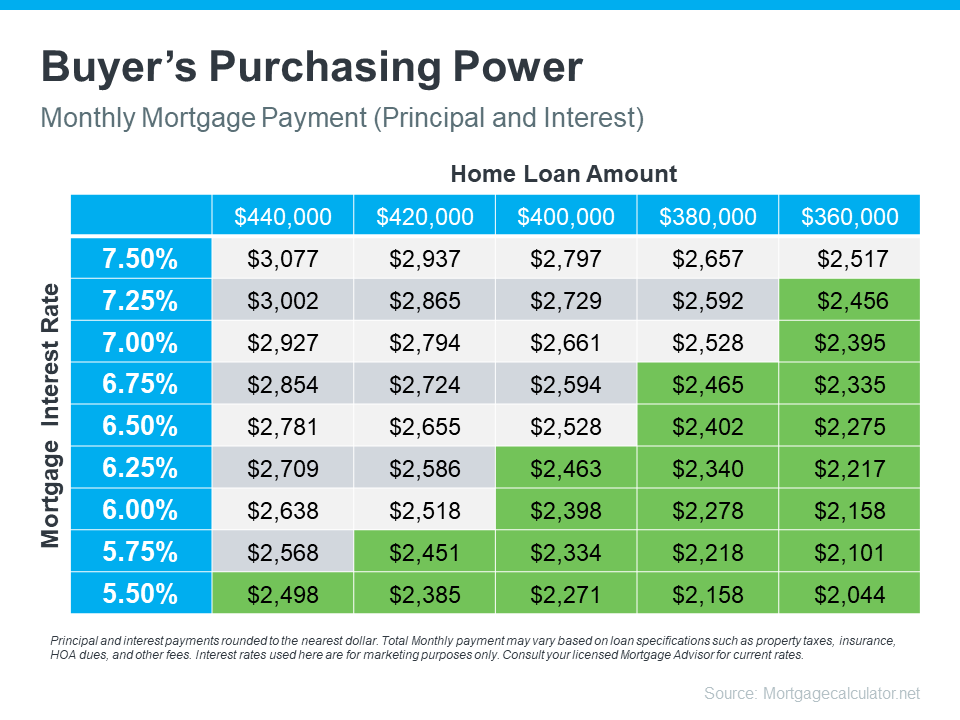

This softening of interest rates can certainly help with your plans to buy a home. Let’s look at an example.

How Mortgage Rates Affect Your Search for a Home

Below is a scenario where you can afford to pay $2,500 for a monthly mortgage payment. The green segment in the chart represents payments within your budget (see chart below):

Even minor rate fluctuations can have a major effect on the loan amount you can afford.

Get Help from Reliable Experts To Understand Your Budget and Plan Ahead

Get the support you need by collaborating with a local, knowledgeable real estate agent and a trusted lender. They’ll help you explore the mortgage options (there are so many), understand how and why rates fluctuate, and know how these changes directly affect you.

Look at the numbers and trends with your support team and adjust your strategy based on today’s rates. This will make you better prepared to buy a home.

Bottom Line

So, if you’re looking to buy a home, you should know the recent downward trend in mortgage rates is good news for your move. Let’s connect and plan your next steps.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link