When mortgage rates surged in recent years, many homeowners paused their plans to move—maybe you did too, avoiding a higher mortgage rate on your next home. This “rate freeze” is understandable, but is it still the right strategy?

More homeowners are adjusting to today’s market, thinking it may be time to move. As Mark Zandi, Chief Economist at Moody’s Analytics, explains:

“Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly coming to the realization that mortgage rates aren’t going back anywhere near the rate on their existing mortgage.”

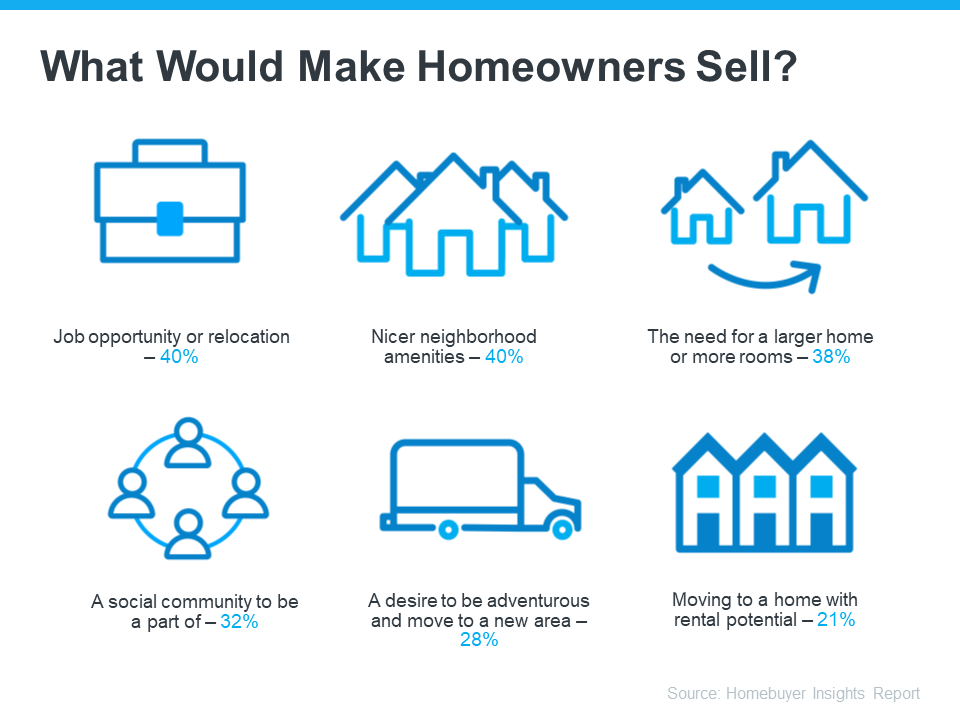

A recent study from Bank of America sheds light on some of the things homeowners say would make them sell, even with rates where they are right now (see visual below):

What Would Motivate You To Move?

Life events like births, deaths, marriages, divorces, or job changes often prompt people to move, regardless of the economy. As life unfolds, your need or desire to move naturally changes.

Another factor to consider: mortgage rates are expected to continue decreasing slowly this year. As that happens, the buyer pool will incrementally grow, creating more competition. Waiting for lower rates could mean facing tougher competition later.

So, is now the right time to move? It depends. Consider current rates, where they’re headed, and what life changes might drive your decision. An expert can help you weigh your options.

Bottom Line

Many homeowners are adjusting to current rates and choosing to move. Let’s discuss your goals so you can decide if now is the right time for you to re-enter the market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link